AB 3088: The New 15 Day Eviction Notice Flowchart

February 1, 2021 update – SB-91 updated 15 Day Notice to Pay or Quit

Do you need to serve your tenant a 3 or 15 day notice? We can serve your tenants the same day! Call us at 1-800-686-8686

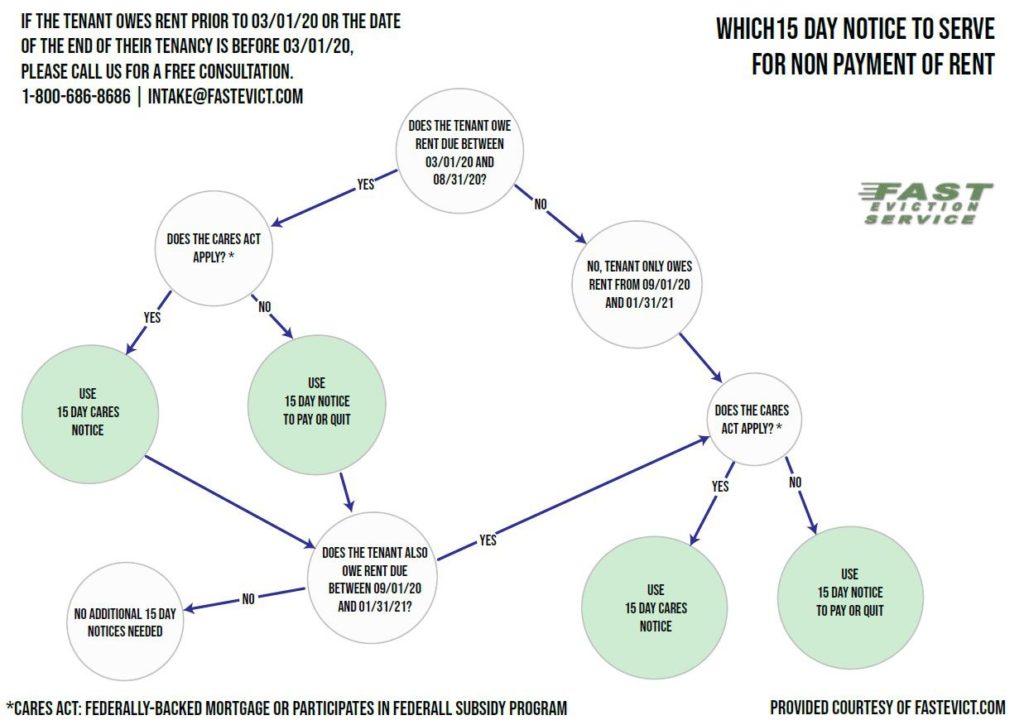

We’ll be discussing the new 15 day notice in California flow chart for this particular blog post. You can read the key takeaways from AB 3088 here or you can read the entire bill here. We also had a webinar about the important takeaways of AB 3088 which you can watch the replay here.

AB 3088, or the COVID-19 Tenant Relieve Act of 2020, is a bill that provides protections against eviction to tenants that meet certain criteria.

Let’s clarify the AB 3088 15 Day Eviction Notice requirements, the flow chart and important things to keep in mind.

The tenant failed to pay rent between March 1, 2020 – August 31, 2020

If the tenant failed to pay rent and or their rental agreement ended before March 1st, 2020, please call us for a free consultation.

Landlords are not allowed to evict a tenant for failing to pay rent between 03/01/20 and 08/31/20 if and when the following is met.

Tenant requirement

- The tenant provides a declaration to the landlord explaining how their financial hardships due to COVID-19 prevented them from paying rent. High income residents could be required to show proof of this hardship.

Landlord requirement

- The landlord is required to provide information about AB 3088 to any tenant who has missed any rent payments from March 1, 2020 to August 31, 2020 as of September 01, 2020. If you haven’t served your tenant with information about AB 3088 and their rights, we recommend you do it immediately.

- If your property qualifies for CARES Act protection, you must serve your tenant with a 15 Day Cares Eviction Notice. If you property does not qualify for CARES Act protection, you can use a regular 15 Day Eviction notice in California.

The tenant fails to pay rent from September 1, 2020 – January 31, 2021

Landlords are not allowed to evict a tenant for failing to pay rent between 09/01/20 and 01/31/21 if and when the following is met.

Tenant requirement

- The tenant provides a declaration to the landlord explaining how their financial hardships due to COVID-19 prevented them from paying rent. High income residents could be required to show proof of this hardship.

- The tenant pays at least 25% of rent due between September 1, 2020 and January 31, 2021 by January 31, 2021.

Landlord Requirement

- The landlord is required to provide information about AB 3088 to any tenant who misses any rent payments from September 1, 2020 to January 31st, 2021.

- The landlord must serve the tenant with a 15 Day Eviction Notice before being able to file an unlawful detainer in court if your property is not subject to the CARES Act. If your property qualifies for CARES Act protection, you must serve your tenant a 15 Day Cares Eviction Notice.

The AB 3088 15 Day Eviction Notice

The new 15 Day eviction notice in California should be served whenever a tenant fails to pay at least 25% of their rent and they provide a written statement on how COVID-19 affected their ability to pay the full amount as of September 1, 2020.

Does a 15 Day Eviction Notice count weekends?

No, you don’t count the weekends or judicial holidays.

Is 15 Day notice an eviction?

No. A 15 day notice is not an eviction. If the tenant ignores it, however, the notice would be the first step of the legal eviction process.

What is the CARES Act?

The Coronavirus Aid, Relief, and Economic Security (CARES) Act provides protections from evictions and fees caused by the failure to pay rent to tenants who live in federally subsidized or federally backed homes.

Your rental property qualifies under the CARES Act if

- Your tenant receives federal aid from a voucher or grant program.

- You or your tenant receive some sort of aid through federally subsidized housing programs.

- Your property or building has a federally-backed mortgage.

Do you need help serving a COVID notice to your tenants?

Call us!COVID-19 Eviction Protections Flow Chart

You can download a PDF copy of the new 15 day notice flow chart here.

March 1, 2020 through August 31, 2020

- Tenant fails to pay rent

- Serve tenant with a 15 day notice

- Provide tenant with information on how to receive COVID-19 hardship benefits

- Provide a blank declaration form

If the tenant provides the written declaration form, the landlord cannot evict a tenant for nonpayment of rent for these dates.

September 1, 2020 through January 31, 2021

- Tenant fails to pay rent

- Serve tenant with a 15 day notice

- Provide tenant with information on how to receive COVID-19 hardship benefits

- Provide a blank declaration form

- Tenant must pay at least 25% of rent owed before January 31, 2021.

If the tenant provides the written declaration form and pays 25% of their rent owed, the landlord cannot evict a tenant for nonpayment of rent for these dates.

How can I collect owed rent?

It’s important to understand that AB 3088 does not forgive owed rent. The tenant still owes the landlord any rent not paid from March 1, 2020 through January 31, 2021.

The amounts owed will be converted to consumer debt. The landlord can recover owed rent by filing in small claims court.

Currently, you can only sue for less than $10,000 in small claims court but AB 3088 allows a landlord to attempt to recover any amount of rent owed including those amounts that are over the $10,000.

Landlords can file small claims cases as of March 1, 2021 for any rent owed between March 1, 2020 through January 31, 2021.

We can help you recover your owed rent! We can file a small claims action on your behalf AND collect it for you. Learn more here.

If you have any additional questions or concerns, please call us at 1-800-686-8686 for a free consultation.

Filed under: News and Updates